Get past the AI noise: How one predictive model is changing underwriting

In life insurance, the term “automated underwriting” has been thrown around a lot in the past few years. And why not? In theory, it’s a game changer—using vast troves of insurance data, AI and machine learning algorithms to accelerate the underwriting process. What’s not to like?

In practice, however, there’s a good deal of postulating out there. In an industry that is notoriously slow to adopt new methodologies, everyone is talking the talk, but not many are walking the walk.

Add to that, the explosive rise of generative AI, which is taking over board rooms and business strategies worldwide. It seems that businesses have prioritized implementing virtually any AI program so that their marketing team can launch a new campaign promoting their innovative, relevant and ahead-of-the-curve solution.

The truth is that AI has been around a long time, but few insurers have put it into practice in a truly meaningful way.

And that’s a shame, because as the pretenders raise the marketplace’s cynicism quotient, they poison the well for the real deal, the breakthrough solutions that have changed the game.

The grandma of predictive analytics

We launched LifeScore Med360SM way back in 2018. That makes it a veritable grandma of predictive models for life insurers. It’s tested, dependable, predictable and always tells you the truth when you need it.

It took a massive amount of underwriting data and mortality outcomes from life insurance applications—nearly 20 years of it—to build v1 of LifeScore Med360. Since then, we continued to improve the model with more data, more refinements and more outcomes.

Today’s model was built on over 1.75 million applicant records and more than 13 million exposure years. It uses AI and machine learning to generate a reliable, transparent risk score based on lab test results and personal and family health history.

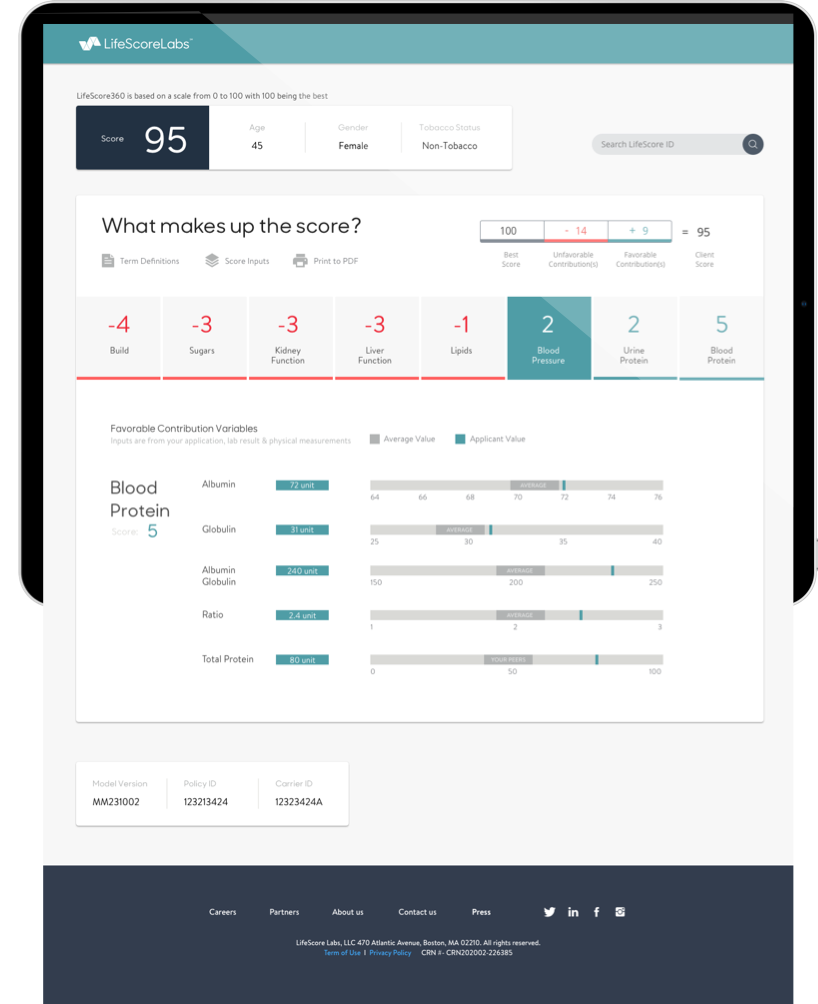

The model automatically generates a simple, transparent Score Report that displays an applicant’s risk in a quick, easily explainable, at-a-glance format. It also describes how each factor contributed to the overall score and how it compares to the median values of similar applicants.

An eye-opening comparison

When LifeScore Med360 is used to automate risk assessment, carriers can speed underwriting decisions, with faster offer rates, higher take rates and lower costs.

Those benefits aren’t hypothetical; they’ve been proven (another benefit to being the old kid on the block is having the time to study results). In a simulated test comparing LifeScore Med360’s results to the decisions reached by underwriters on 850,000 historical applications, LifeScore Med360 outperformed traditional underwriting despite having fewer data sources available to it.

Underwriters screened for financial suitability, reviewed prescription drug history and checked MIB records, etc., for a more complete view of an applicant. Yet even without this additional information, LifeScore Med360 still outperformed traditional underwriting.

LifeScore Med360 by the numbers:

- 9% fewer deaths at 15 years for a best class (ultra-preferred)

- 10.5% better overall mortality experience

- 25% faster approval times

- 30% greater acceptance rates among ultra-preferred applicants

With predictive modeling, older is better

There certainly are other, lesser underwriting models out there, but they’re often trained to replicate underwriters’ decisions. If their optimal performance is achieved, it matches decisions that underwriters have made in the past. Other models estimate risk based on alternative data sources that don’t offer the protective value provided by a medical exam.

LifeScore Med360, on the other hand, was developed on the same industry-proven underwriting data used for decades: medical history, medical exam and lab values. Using advanced machine learning techniques, LifeScore Med360 captures nonlinear relationships and nonparametric interactions between variables. As a result, it’s better at finding hidden risks and assessing each applicant, than rules-based and traditional underwriting processes.

Another key reason LifeScore Med360 has outperformed other risk models is the veracity of its training data. AI and machine learning algorithms are only as good as the data on which they’re trained. To guard against overfitting and to optimize performance, LifeScore Labs’ data scientists tested and validated on multiple dimensions. Extensive experiments are iterated on feature selection, variable transformation and hyperparameter tuning and sampling techniques.

Historical results from AI-created predictive models are somewhat rare these days and few models have been proven to match LifeScore Med360's results of improved risk selection, reduced mortality losses, lower costs and accelerated underwriting decisions and offer rates

LifeScore Med360 is getting even better with time as more updated applicant information, exposure years and observed deaths are used to retrain the model.

Get past the noise and try LifeScore Med360 for yourself.